Looking to book your next getaway and wondering: can you book flights and pay later or can you pay for flights in instalments? You’re not alone. With the cost of international travel rising and the general cost of living going up, 4 out of 5 Brits say that their travel plans have been affected.

More and more people are looking for ways to make their holiday payments more manageable, and one of the best ways to do that is to pay for flights in instalments. After all, it’s much more manageable to have an affordable amount coming out after payday every month than forking out a big lump sum in one go!

So, whether it's a last-minute escape or the trip you’ve been dreaming about for years, splitting the cost means you can make it happen now—without that post-booking panic.

But not all instalment options are equal.

Some come with hidden costs, high interest rates, or sneaky fees that can catch you off guard. So, before you jump in, the Vuelo team has put together the most popular ways you can pay for flights in instalments. That way, you can figure out the best option for your next adventure in a few minutes.

Paying for flights in instalments isn’t just a convenient option—it’s a smart way to manage your holiday budget. Here’s why staggered payments can make all the difference:

Need to keep an eye on your cash flow? Instalment plans are designed to do just that. By breaking down the total cost into smaller, manageable payments, you avoid the stress of paying everything upfront.

You can book your flights now and still have money available for things like hotels or transfers. And you still get to pay your flights off over time. Win win.

Smaller, regular payments mean more breathing room in your budget. Whether you’re eyeing a five-star upgrade, planning to splurge on local cuisine, or just want extra cash for some fun nights out, instalments keep your budget flexible.

With the pressure off, you can plan a more fulfilling trip without constantly counting every penny.

Imagine locking in your flights today, knowing you’ve got months to pay them off. No more worrying about price hikes or scrambling for funds last minute. Staggered payments give you peace of mind and the freedom to focus on the fun parts of planning your holiday.

Grab your tickets now and let the instalments take care of themselves—stress and hassle free.

When it comes to paying for flights in instalments, you’ve got plenty of options—some good, some… well, not so good.

We’ve broken down the most common ways you can spread the cost of your flights so you know exactly what you’re getting into.

Let’s find your best option to keep your travel dreams alive and your bank account looking healthy.

Credit cards are a popular choice for a reason. Nearly a quarter of Brits report using the flexibility of credit cards to pay off flights in instalments. (Plus, some credit cards even offer perks like travel points or insurance.)

But before you run for your wallet and start typing in your card details, here’s what you need to know:

How it works:

Book your flights using a credit card and pay off the balance over time. Depending on your card, you could earn points or cashback.

Credit cards work best when you’re sure you can pay off the balance fast—otherwise, those interest rates can snowball and throw your finances off course.

So before you pay using a credit card, make sure you look into interest rates. If there’s an interest-free period and you’re confident you can maintain payments over a long period, they’re not a bad option.

A lot of airlines and travel agencies now offer their own instalment plans, making it simple to spread costs directly with them. But like credit cards, it’s good to know what to expect before you agree to a payment plan for airline flights.

How it works:

Book your flights through an airline or travel agency, and they set up a payment schedule—often with interest attached.

Travel agency and airline ticket plans can work, but it’s always a good idea to check the terms and conditions. Interest rates and fees can vary – especially with smaller/alternative airlines – so know what you’re signing up for before you board.

Always make sure that you’re using legitimate websites and finance platforms. And remember, if anything seems too good to be true, it probably is.

Buy Now, Pay Later (BNPL) options are popping up everywhere and more and more people are choosing them to manage payments. In fact, about 50% of Brits have used BNPL services for everything from online shopping to flights.

How it works:

BNPL services like Klarna and Afterpay let you split your flight cost into smaller, regular payments like weekly or monthly instalments, often with an interest-free period (if you pay on time). Normally, you book your flights through an airline or travel agent and then choose the BNPL option on the payment page.

If you stick to your payment schedule, BNPL services are a really good way to split the payments for your flights.

The only problem with generic BNPL? Some aren’t entirely catered for booking a holiday. So while you can make them work, you’ll still have to book your flight in one place with one BNPL solution and your accommodation with another. It can be a bit of a juggling act.

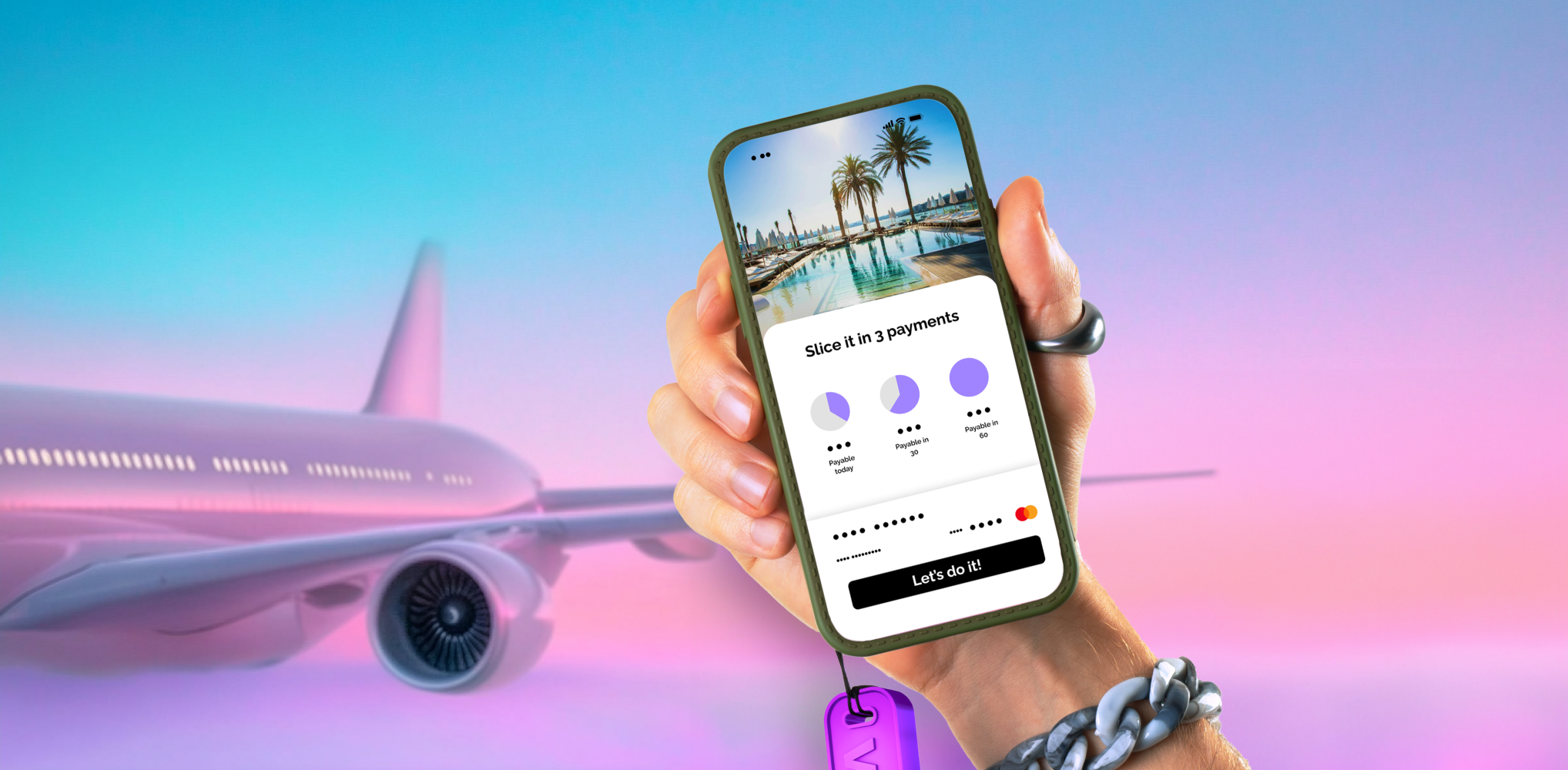

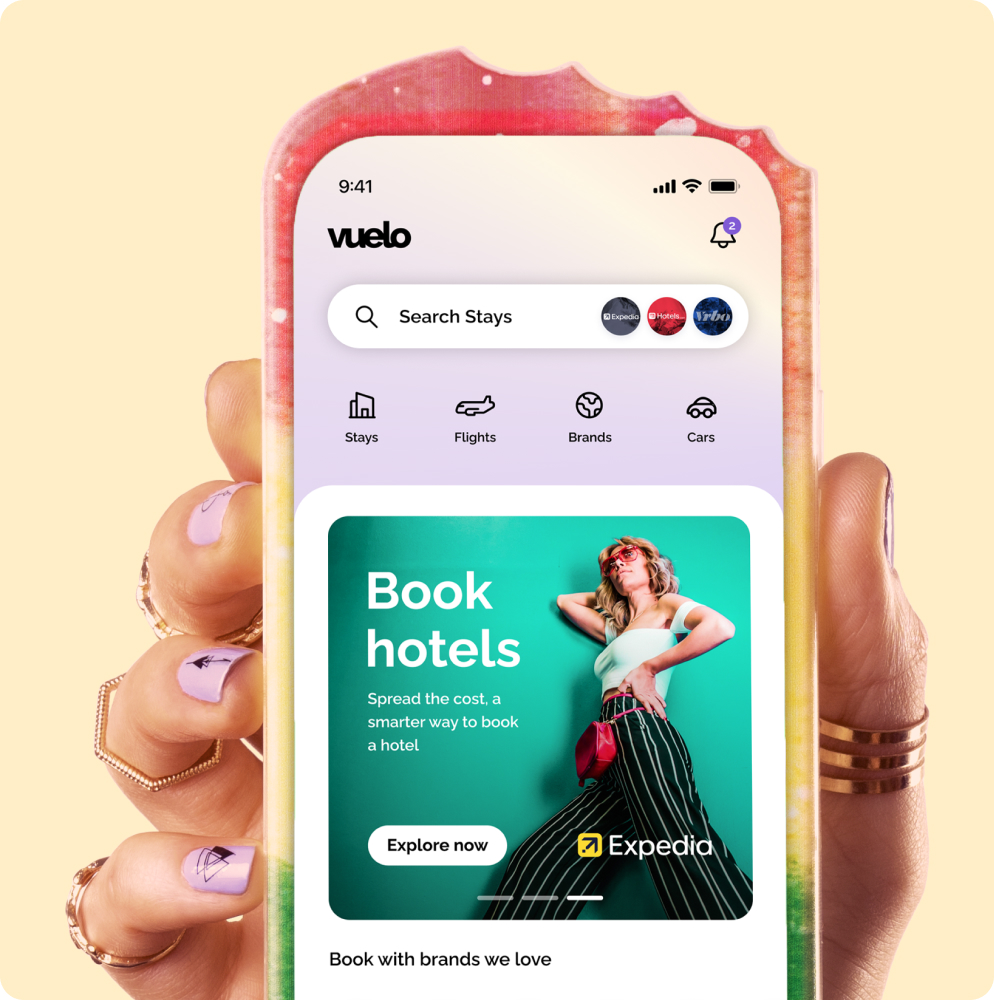

Unlike other BNPL options, Vuelo is designed specifically to let travellers book their trips today and pay for them over time. We’ve built everything to give you full flexibility, transparency, and access to zero-interest payment options.

How it works:

Book your flights (and hotels, trips, Airbnbs, etc…) through the Vuelo app and set up a custom instalment plan that fits your budget, with interest-free options.

Designed with travelers in mind, Vuelo offers the simplest and safest way to spread the cost of your flights—no surprises, just easy, stress-free travel planning. The platform has been built specifically for booking and paying for flights, hotels and more all from one app. It’s the easiest way to spread the cost of your next trip, if we do say so ourselves.

Get the appReady to book your next holiday and spread the cost with no stress? With Vuelo, it’s as easy as a few taps on your phone. Here’s your step-by-step guide to getting those flights locked in, interest-free, and on your terms.

First things first — down the Vuelo app. You can find it on both the App Store and Google Play, so whether you’re team iPhone or Android, we’ve got you covered.

Downloading takes seconds, and then you’re just minutes away from unlocking the best flight deals and flexible payment plans.

Once you’ve got the app, it’s time to create your account. You’ll need to enter some basic details—think name, email, and payment info—nothing too heavy. Vuelo will then run a quick eligibility check to make sure everything’s good to go. Don’t worry; it’s a lightweight process compared to credit card checks.

What You Need:

Have your details ready to speed things up. The whole process takes under five minutes, so you’ll be browsing flight deals in no time.

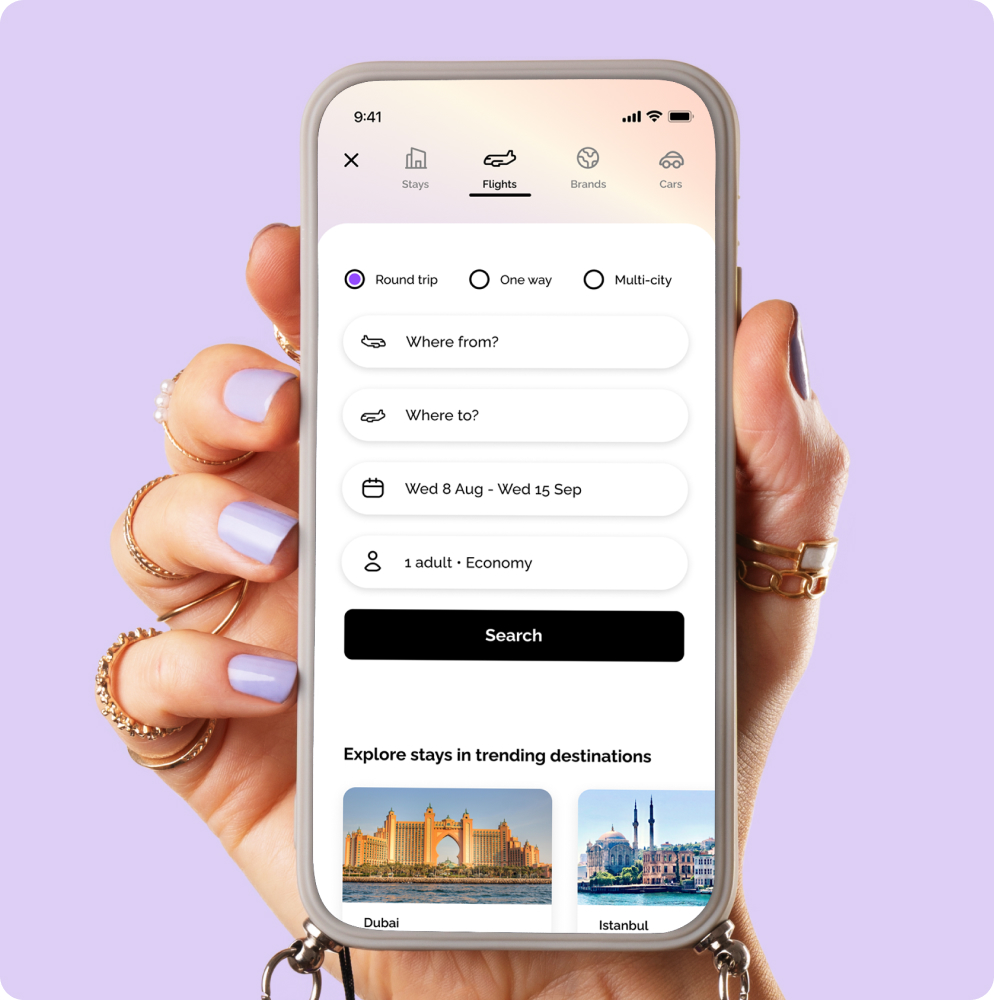

Now the fun part—finding your flights. Vuelo’s search function lets you explore multiple dates, destinations, and airlines all at once, so you don’t have to jump between a million tabs.

What You Need:

Vuelo’s built-in price comparison means you can see all your options on one screen—no more back-and-forth between booking sites.

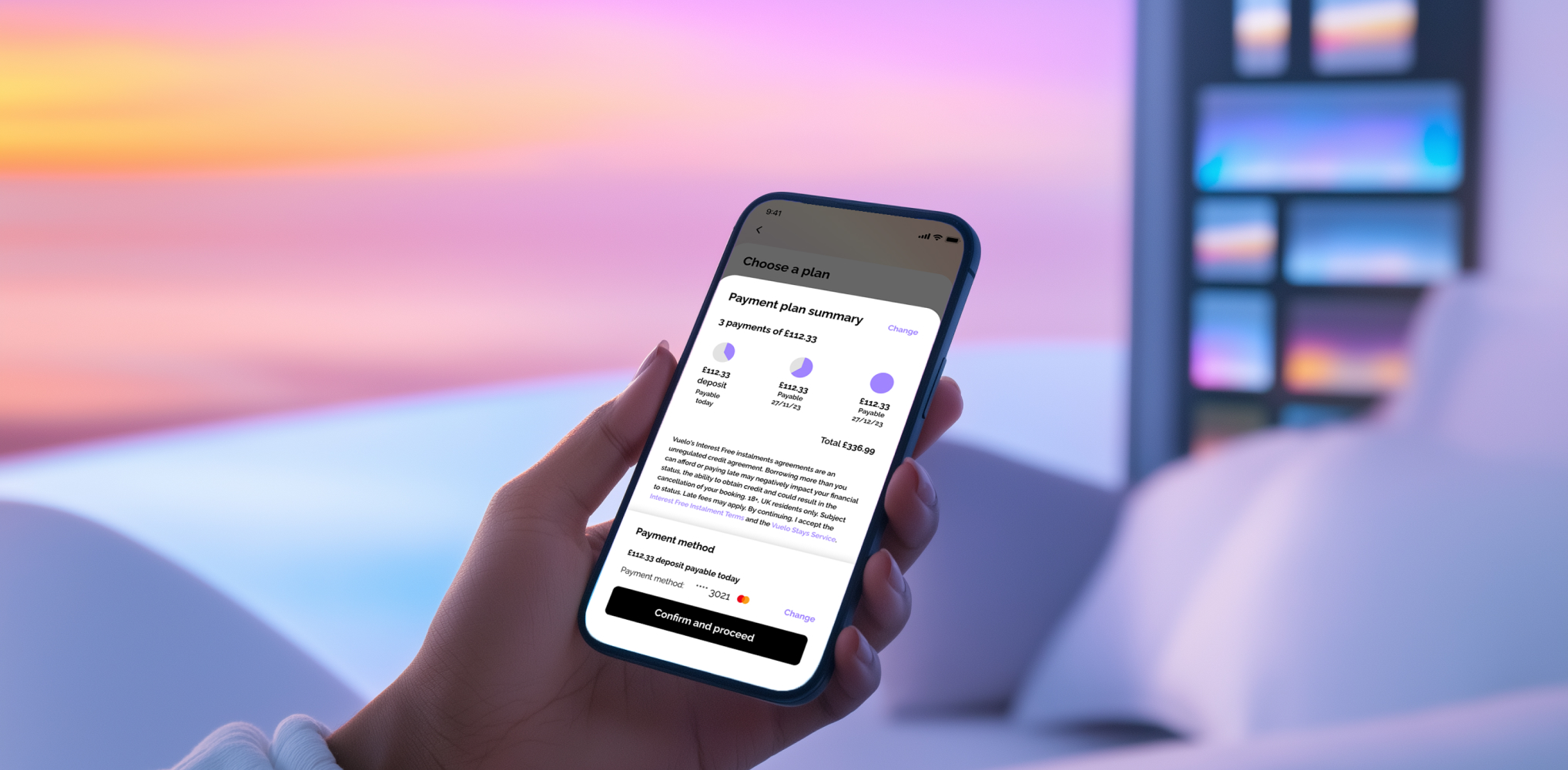

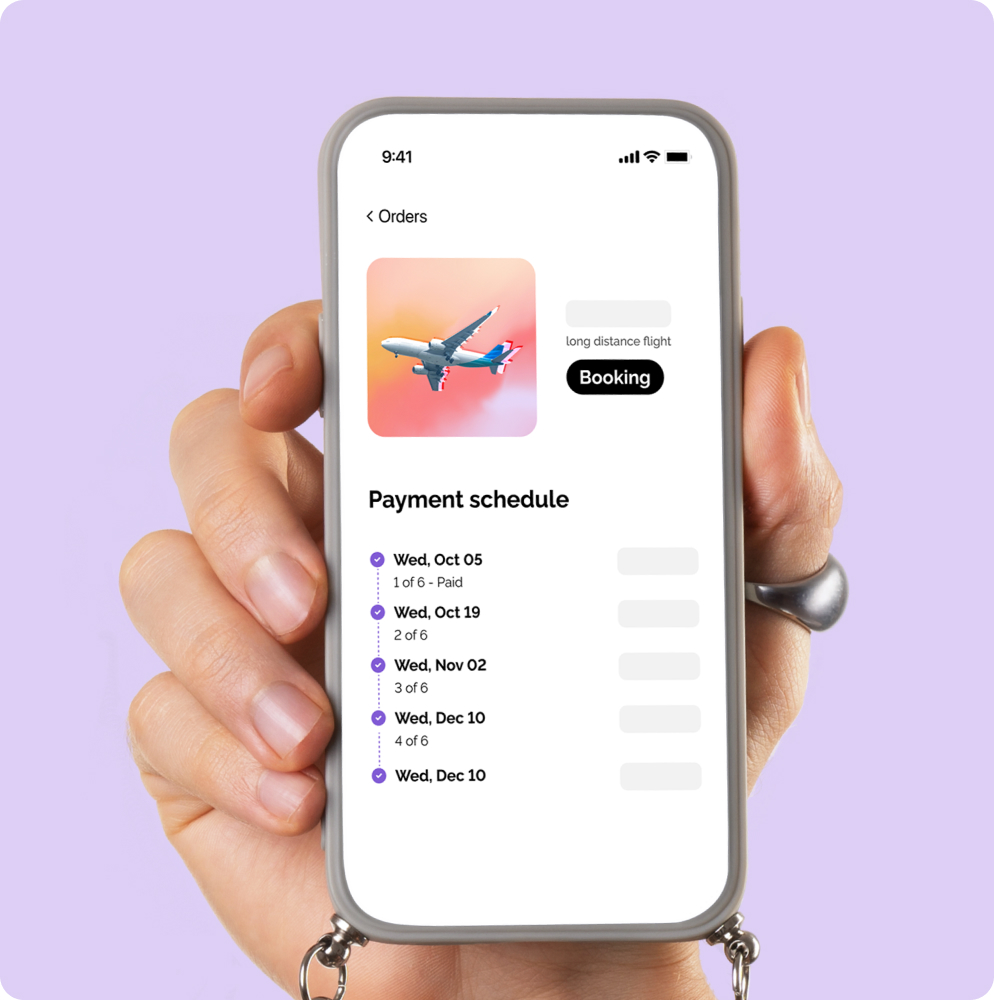

Found your perfect flight? Great. Now, let’s make the payment process as smooth as possible. Vuelo offers flexible instalment plans that fit your budget and schedule.

Options available:

Unsure about your plans? Vuelo lets you adjust the schedule if your travel dates shift—keeping things stress-free.

Double-check everything, confirm your payment schedule, and you’re ready to take off! We’ll send you a confirmation email with all the details, and you can track your booking and payments directly through the app.

What happens next:

With Vuelo’s reminders, you’ll never miss a payment. So, relax and start planning the rest of your holiday—your flights are officially sorted.

So, there you have it—choosing to pay for flight ticket in instalments doesn’t have to be complicated or risky. You can quite literally fly now, pay later.

With Vuelo, you’ve got a simple, flexible, and interest-free option that puts you in control. Whether you’re planning a quick weekend getaway or a long-awaited escape, Vuelo makes it easy to lock in the best deals and spread the cost without stress.

TLDR: why choose Vuelo?

Ready to take the hassle out of holiday planning and booking flights? Download the Vuelo app today and start exploring your options. You’ll be one step closer to your dream holiday, with the peace of mind that your plane tickets are covered, on your terms.

Start booking smart. Your next adventure awaits!

Ensure you can make repayments on time. You must be 18+ and a permanent UK resident. Vuelo charges a £12 late fee for each late instalment. Missed payments may affect your ability to use Vuelo in the future. Vuelo's Interest Free instalment agreements are not regulated by the Financial Conduct Authority. T&Cs and other eligibility criteria apply.

today to pay for your holiday without financial anxiety. Spread the cost over flexible interest-free payments.

Get the app