16 October 2024 - min read

Thinking of applying for a holiday loan? Here’s a rundown of everything you need to know about spreading the cost of that much-needed getaway.

You just can’t beat the excitement of stepping off the plane and jumping in a cab to the hotel. That first ice-cold drink by the pool and the prospect of time away from the noise of everyday life? Nothing compares.

In fact, studies show that travelling makes you calmer and less stressed and that feeling lasts for weeks (even when you’re back in the office).

But those benefits don’t last all that long if you get hit with hefty holiday loan repayments the moment your return flight lands.

With the cost of pretty much everything on the rise, two-thirds of Brits struggle to afford holidays abroad. So it’s no surprise that about 20% of people use credit cards to pay for holidays and more and more are turning to other finance options like holiday loans.

If you’re planning your next holiday and wondering if borrowing money with a holiday loan is the right choice for you, you’re in the right place. We’ve picked the Vuelo team’s brains on holiday loans and put together everything you need to know about them.

By the end of this quick guide, you’ll be able to book your next getaway and know you’ll come back worry-free (and with an incredible tan, hopefully).

Everyone needs a holiday — in fact, research shows that we should all probably go on more than one holiday a year for our mental well-being. Holidays are a chance to take a step back, relax, and forget about everyday life. But with the cost of everyday life rising, it’s more difficult to pay for holidays in one lump sum.

That’s where holiday loans (and other options) come into their own.

If you want to borrow money for a holiday, holiday loans are pretty much what they say on the tin. They’re a type of personal loan that is specifically for helping people afford holidays.

In more technical terms, a holiday loan is an unsecured (meaning you don’t need to put up any collateral) personal loan that lets you split the cost of your trip. They’re designed for anyone who doesn’t have all the money upfront or would rather split the payments over a longer period.

Holiday loans are a quick solution when you’re planning your dream trip. They can be a good solution for some people but the repayment process can add stress to your finances long after you get home.

If you’re thinking about getting a loan for a holiday, we highly recommend thoroughly researching your options and using a trustworthy holiday loan calculator. That way, you can see repayment costs and how interest affects your overall holiday costs before you get a holiday loan.

And even if you think a holiday loan could help and work for your personal circumstances, it’s not the only way to borrow money for a holiday.

When it comes to booking and paying for your holiday, it’s good to know all the ways you can borrow money to travel.

Unfortunately, not all holiday lending and financing options are created equal and while none are entirely risk-free, some come with significantly less risk.

We’ve put together the pros, cons, and risk levels of all of the most common ways to pay for a holiday ( so you can find one that works best for you.

A personal loan is a popular way to finance a holiday. They work in pretty much the same way as a holiday loan as it’s an unsecured loan but give you more flexibility. This means you can use it to pay for more than just your holiday if you choose to. (For example, you could borrow enough to pay for the holiday and renovate your kitchen.)

You borrow a set amount from a bank or lender, usually between £1,000 and £25,000, with a fixed interest rate. You pay your loan back in monthly instalments typically over 1 to 7 years. Because it's unsecured, you don't need any collateral, but your credit history and score matter—better credit means a better rate.

Personal loans can be a reliable way to pay for your holiday, especially if you’ve planned your budget. But they come with a long-term commitment, which can be a downside if your financial situation changes.

Credit cards are a common go-to for holiday spending. They offer flexibility, and with the right card, you might even benefit from perks like travel insurance or reward points.

You charge holiday expenses to your credit card and repay over time, either in full or in monthly instalments. Interest rates vary, but many cards have a grace period—meaning no interest is charged if you pay the balance off quickly.

Credit cards are convenient but come with the risk of accumulating high-interest debt. But they’re a really good option if you can pay off the balance quickly and take advantage of perks.

An overdraft is when your bank allows you to spend more money than you have in your account, essentially borrowing from your bank to cover expenses. It can be an easy way to manage unexpected costs while traveling.

You agree with your bank on an overdraft limit, and if you dip into it, you’ll pay interest or fees on the amount you’re overdrawn. Some accounts offer interest-free overdrafts up to a certain limit, but this usually only applies for a limited time.

An overdraft can work for covering small gaps in your holiday budget, but the fees can add up quickly if not managed carefully. It’s far more suitable for emergencies rather than financing an entire holiday.

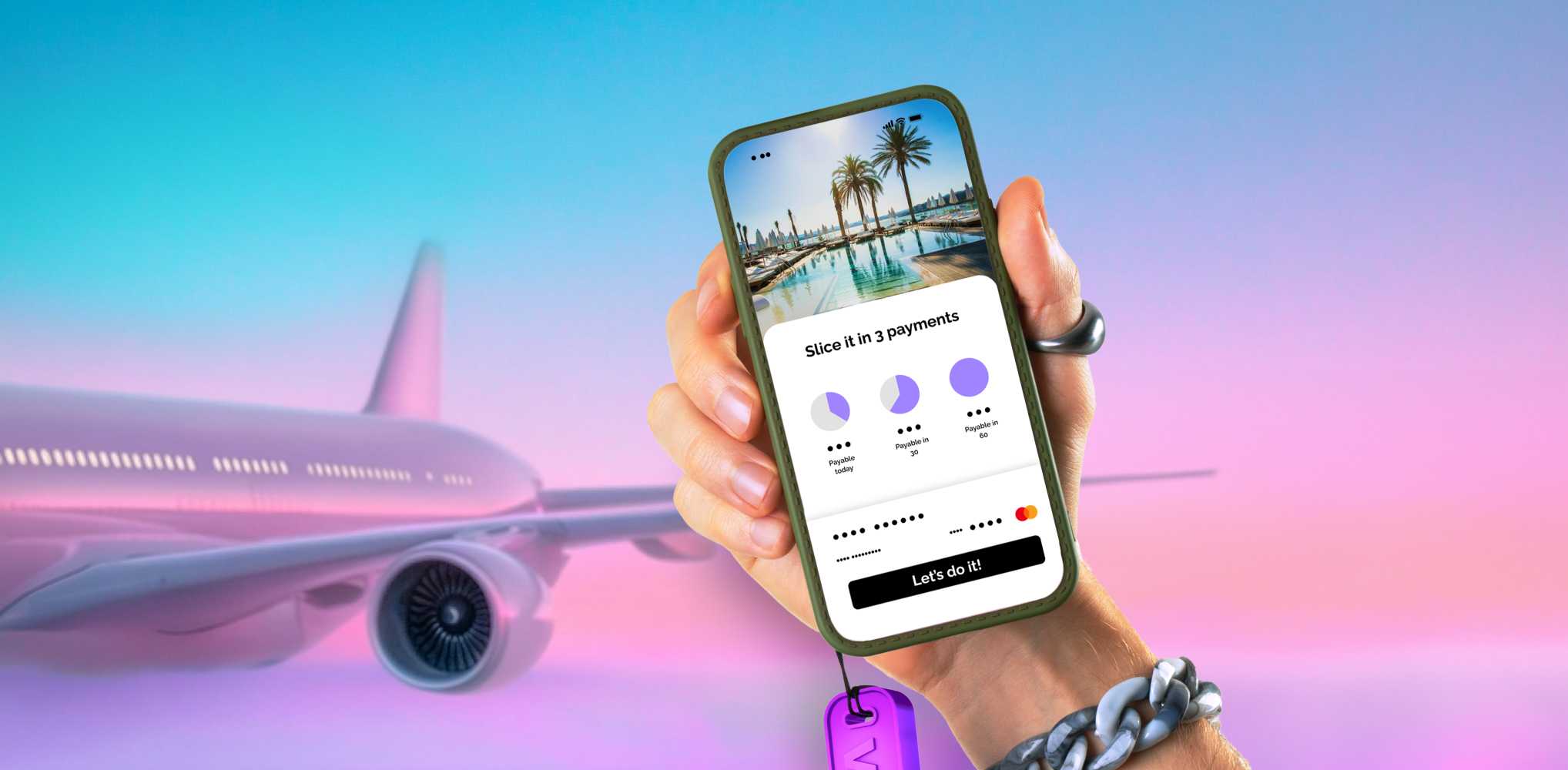

Buy Now Pay Later services – like us, hey 👋 – let you split the cost of your holiday into manageable chunks, often with no interest if repaid on time. It’s a flexible option that has grown in popularity in recent years, especially for larger purchases like holidays.

BNPL services like those offered through Vuelo allow you to book your holiday and pay in monthly instalments. Many BNPL options offer interest-free periods, which means you can spread the cost without additional charges—if you stick to the repayment schedule.

An overdraft can work for covering small gaps in your holiday budget, but the fees can add up quickly if not managed carefully. It’s far more suitable for emergencies rather than financing an entire holiday.

Get the app| Option | Pros | Cons | Vuelo Safety Verdict |

|---|---|---|---|

| Holiday Loans |

|

|

Fast but risky long-term |

| Personal Loans |

|

|

Reliable but requires a long-term commitment |

| Credit Cards |

|

|

Flexible, but the interest can add up fast |

| Overdrafts |

|

|

Useful for the short-term, costly long-term. |

| Buy Now Pay Later |

|

|

Safest option: flexible and interest-free |

Taking out a loan for a holiday might seem like a good idea when you can’t wait to get away from the daily grind, but the repayment stress can linger long after your tan fades. Why let financial worries follow you home when there’s a better way to finance your dream getaway?

With Vuelo, you can enjoy all the benefits of booking your holiday now without the added stress of high-interest repayments. The Vuelo app makes it easy to find the cheapest flights, snag last-minute deals, and compare prices—all while giving you the flexibility to spread the cost over time.

Ready to change how you plan your holidays? Here’s how Vuelo helps:

Ensure you can make repayments on time. You must be 18+ and a permanent UK resident. Vuelo charges a £12 late fee for each late instalment. Missed payments may affect your ability to use Vuelo in the future. Vuelo's Interest Free instalment agreements are not regulated by the Financial Conduct Authority. T&Cs and other eligibility criteria apply.

today to pay for your holiday without financial anxiety. Spread the cost over flexible interest-free payments.

Get the app16 October 2024 - min read